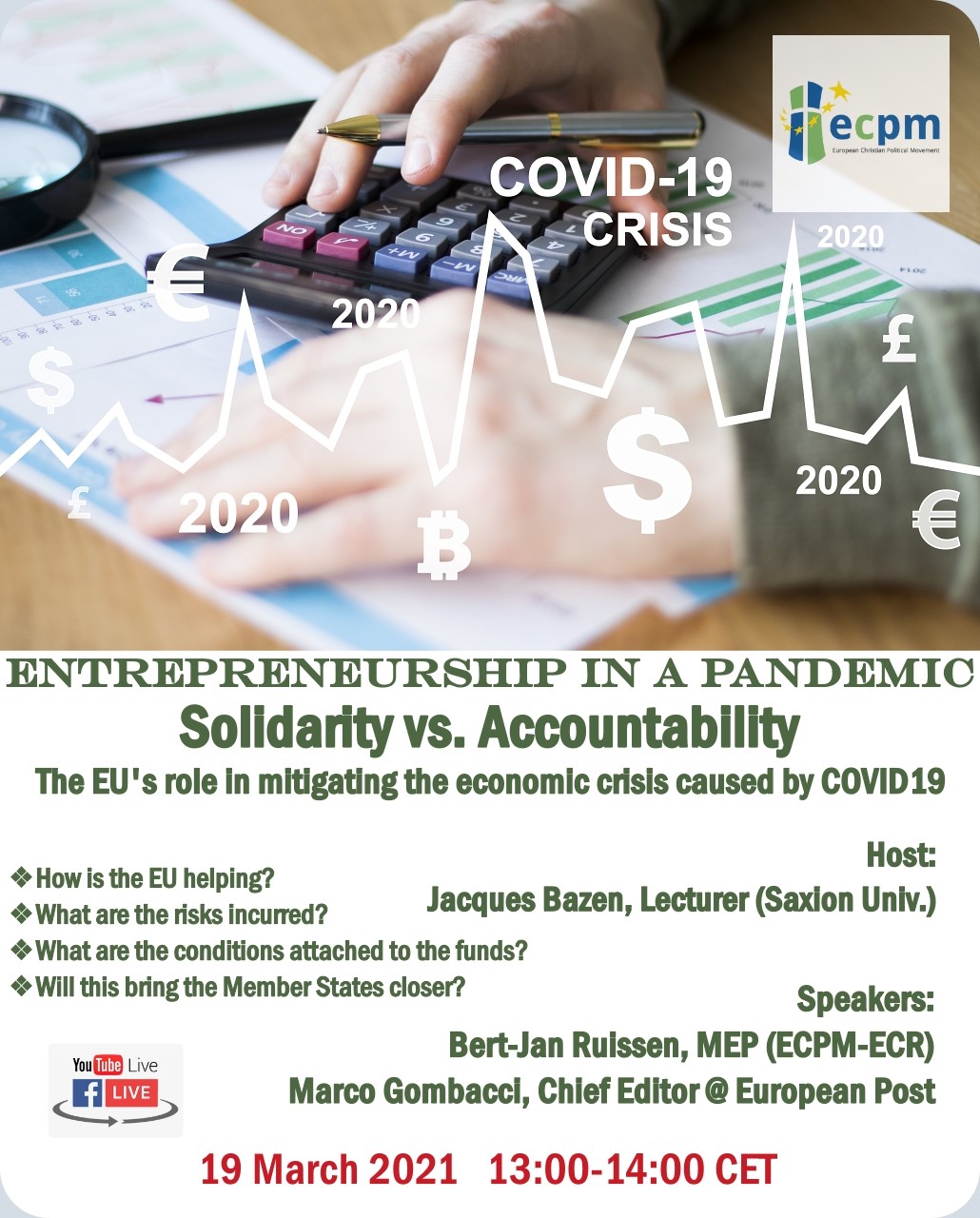

Friday, March 19, 2021 13:00 - Friday, March 19, 2021 14:00

ENTREPRENEURSHIP IN A PANDEMIC. Solidarity vs. Accountability- EU's role in mitigating the economic crisis caused by COVID19

Host: Jacques Bazen, Lecturer in Entrepreneurship and Innovation Management at Saxion University

Speakers: Bert-Jan Ruissen, MEP // Marco Gombacci, Chief editor at The European Post

The two speakers discussed the Recovery Fund (Next Generation EU), which together with the Multiannual Financial Framework, amounts to almost 2 trillion euros over the next few years.

The Recovery and Resilience Facility is the main component of the temporary recovery fund and consists of both loans and grants awarded to EU member states based on their recovery plans submitted to the EU. It is meant to overhaul the economies of the most affected countries in the Union by fostering innovation and helping them transition to a green and digital economy.

Most of the money that will be made available in the Next Gen EU fund will be raised on the capital markets by the European Union borrowing large amounts of money at low interest rates. The fund will also be fueled by new taxes: a border carbon tax and financial transaction tax. MEP Ruissen pointed to the fact that this extensive borrowing will create a large debt at the EU level which will be passed on to future generations. As of now, when the interest rates are low, this could be manageable but later on when the rates will increase, repaying the debt might become unsustainable and stifle innovation. The MEP also mentioned the political aspect of this recovery fund, namely that this will make the EU member states more dependent on Brussels and erode the principle of subsidiarity in the long term.

Mr. Gombacci, an Italian journalist living in Brussels and covering European Union news, pointed to the lack of solidarity between the EU member states when the pandemic started and says the recovery fund is absolutely necessary for the hardest hit countries, like Italy, since the member states depend and rely on each other economically.

Mr. Ruissen brought into discussion the existing funds and financial instruments (the cohesion and structural funds) and which hold money that are not being used at the moment, making this large recovery fund almost unnecessary. In addition, those funds could have been disbursed to the sectors most affected much faster than the Recovery and Resilience funds which are yet to be paid out.

The fact that SMEs (which represent 90% of EU economy) were severely impacted by the COVID19 crisis was readily acknowledged by both speakers and they both agreed they should be helped quickly and effectively. Both guests agreed that the recovery funds should not be mis-used on projects that are not urgent or do not have a real usefulness.

At the end of the discussion, the issue of deregulation came up and Mr. Ruissen reminded the audience of the Commission promise that for every new rule introduced, one will be taken out. Excessive regulation discourages small and medium entrepreneurs to start or to scale-up their business; in Italy especially the red tape makes it almost impossible to start a company. Mr. Gombacci also touched on the family aspect of SMEs, saying that excessive regulation would negatively impact family life and family time. It was suggested during this webinar that a close monitoring of the regulation and red tape around the allocation of funds and support for the SMEs is absolutely necessary.

The discussion ended with the speakers answering a few questions from the online audience.